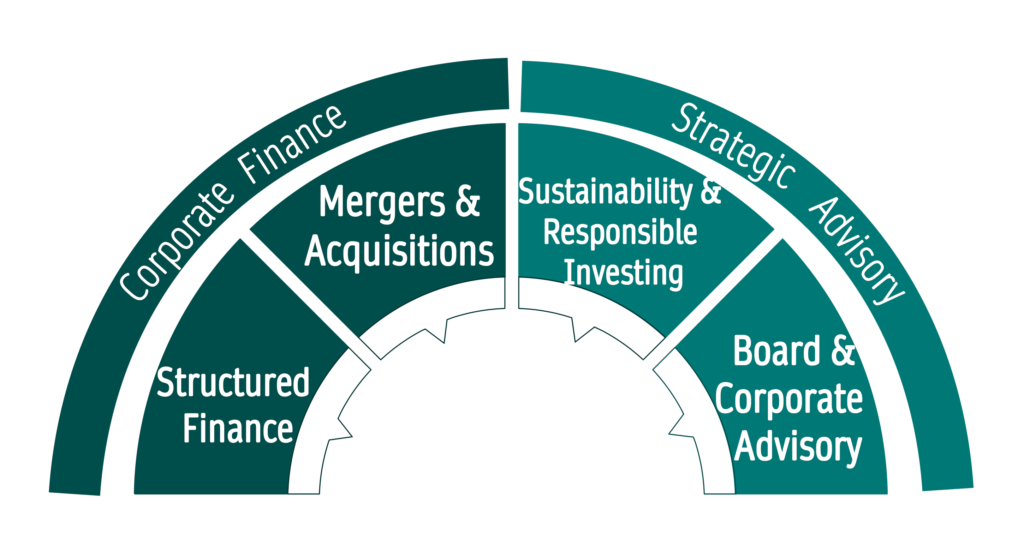

A trusted partner, for a wide range of corporate development transactions and services

CA team’s prior cumulative experience in transactions exceeds USD $1BN in value, spanning from renewable energy, circular economy (waste management & recycling), and natural resources to infrastructure, technology, and financial services.

CA team’s prior cumulative experience in equity capital raising, project finance, IPOs and asset finance transactions exceeds USD $1.5BN in value, spanning from renewable energy, real assets, affordable housing, circular economy, and technology.

CA’s team has a wealth of prior experience and knowledge in advising Boards as well as in shaping Sustainability / ESG strategies to assist investors, C-suite executives, managers and business owners to achieve sustainable growth

Corporate Finance

Corporate Finance

Business Mergers & Sell-Side M&As

Company Acquisitions

Asset & Tax Equity Finance

Project Finance

Strategic Alliances Joint Ventures, PPP, & Privatizations

Investor Searches, Shareholder Replacements, & Divestitures

Debt Financing, Refinancing & Capital Structure Optimization

Leveraged Acquisitions (MBO, MBI, LBO, LBI, BIMBO)

Green Financing Green Bonds

Roll-Ups & Search Funds Acquisitions Advisory

PE / VC Fund Incorporation, Structuring & Funding

Equity Capital Raising

Corporate restructuring and split-offs

Islamic Debt Islamic Funding

Merger Planning & Execution Take-over defense strategies

Mergers, Acquisitions & Structured Finance Advisory

Corporate Finance / M&A Advisory

Corporate Finance / M&A Advisory

We do offer focused M&A advisory tailored to meet the requirements of domestic as well as of cross border transactions, especially for the mid-market and low-mid-market companies as well as for the highly regulated industries.

Our experience enables us to work with corporate boards of directors, executive management teams, and various stakeholders in order to determine optimal structuring and execution, secure the best target but most importantly to “close the deal” and “get the job done”.

With access to more than 3,000 potential buyers / investors and by utilizing best-in-class technology we are a trusted partner, for mid-market and low-mid-market firms.

Sell-Side M&A

Either a business transition or a business growth or any other strategy, a well-designed business sale consumes a lot of resources and can be an extremely frustrating process. If you have not been through this path before, we will ensure that you are fully prepared and that you can benefit from the proper guidance and support. We can find the best available buyer for your company. We will ensure, you will receive the maximum value for your firm.

We have put in place a streamlined process, which maximizes the value that a seller can receive.

Contact us to tell you how we can help you: advisors@chartered.associates

Sell-Side M&A

Either a financial buyer, or a strategic buyer / investor and/or an individual buyer, we have developed a custom and proprietary process to pair / match you with the most relevant selling opportunities. We maintain our proprietary dataset filled with small- and middle-sized businesses from all over the world that could meet your criteria.

We maintain a team of seasoned investment banking professionals, analysts and industry experts.

Contact us to tell you how we can help you: advisors@chartered.associates

M&A PMO: Merger Planning & Execution

Planning and executing a merger – or even a series of acquisitions or mergers – could be a complicated process that requires time, knowledge, and it may be costly. Most of the times requires proper coordination and guidance from multiple expert teams. At Chartered Associates, we have developed a flawless process (backed by deep understanding) of critical business issues from multiple perspectives. We have capabilities in providing project management from an enterprise level, coordinating the legal, IT, and finance functions. Our M&A Project Management operations (M&A PMO) process offers a full range of capabilities that allows buyers to act and react to today’s deal dynamics, swiftly and confidently.

We provide to our clients, tech capabilities like virtual data rooms (backed by reputable tech providers), access to proprietary data bases and to local business intelligence in different geographies as well as other resources to bolster their in-house capabilities for the entire life-cycle of every type of M&A transactions.

The success of a merger calls for in-depth knowledge, and the involvement of the management team is essential in order to build rapport and incorporate the proper governance. For that reason, we maintain a team of seasoned investment banking professionals, analysts and industry experts, who they will for your deal.

Contact us to tell you how we can help you: advisors@chartered.associates

Valuations

We do undertake valuations for sellers, buyers and other participants in the investments landscape.

An accurate valuation is very useful as it provides detailed information on the variables that define a company’s value. It also helps gauge the impact that an improvement or deterioration of each variable can have on the value.

A valuation supports effective discussions and rational arguments, since:

- It allows sellers to know the true value range of its business;

- It helps sellers to realize the strengths and weaknesses of its company and its business ( a significantly important component of a sales process);

- It allows sellers to understand the variables which underpin the value and the impact that potential synergies with the acquirer will have on its future

value and synergies could have an added value;

- It allows buyers to challenge the sellers’ valuation and judge fairly the value of the business that they want to acquire;

5.It allows buyers to assess the current situation and the trends of their target companies’ financial statements

6.It allows buyers to structure properly their offers (based on the cash flows statement)

A valuation is a negotiating tool that will assist you and drive you , either if you are a buyer or a seller, during the negotiating process.

Contact us to tell you how we can help you: advisors@chartered.associates

Corporate Finance / Structured Finance

Equity Capital, PE / VC

With direct access to more than 3,000 equity providers globally (venture capital, private equity firms, family offices, corporations, and endowments) we are able to find the right investor and /or strategic partner for your business, we can help you structure and negotiate the terms of your funding needs. Our strong, nurtured and established network of funding sources can provide a wide array of capitalization structures to best match the requirements of any company’s financial capability and capital requests. We help business owners to understand and use all the available types of funding available in the global markets. We can help you fill your capital gap efficiently and as quickly as possible.

Contact us to tell you how we can help you: advisors@chartered.associates

Asset & Tax Equity Finance

Tax incentives are used more and more in several countries with the view to promote and support the local economies and the job creation. We carry out structures linked to tax deductions for tangible and intangible / digital assets.

We have access and prior experience in hard assets as well as in digital assets financing. With teams in different locations in the world and access to traditional and alternative funding we are capable to structure the right solution for your need on an aggressive timeline.

Debt Financing, Refinancing & Capital Structure Optimization

We approach each transactions differently as each one of them is unique. We do have access to leveraged loans, mezzanine debt, as well as to equity-linked securities, and high-yield bonds. We carry out an analysis to identify the level and type of sustainable debt, we reschedule your company’s liabilities, coordinating the information flows and we negotiate on your behalf with every creditor, until we achieve satisfactory terms that could revitalize the economic position of your estates.

Strategic Advisory

We assist business owners, managers, and investors to plan and define strategy as well as implement business-led technology-enabled change and transformation that produces profitable products, improves performance and delivers sustainable growth. We work closely with boards, we represent committees across a wide array of situations.

ESG Strategy implementation & execution

Corporate Governance framework planning, development & integration

Partnerships (P3), Alliances, JVs & Privatizations

Succession Planning initiatives

Key Performance Indicators

Corporate Culture Design & Optimization

Sustainability impacts, risks and performance for Investors

Strategic Advice, Post Merger Integration

Shareholder advocacy initiatives

ESG Frameworks Training Inhouse Sustainability Seminars

Framework definition Sustainability Scorecard

ESG Data Integration ESG Reporting

Defense strategies for 3rd parties friendly / hostile acquisitions, mergers, & financing activities

Risk Management & Risk Committees

Family Businesses members & Board members training

Sustainability, ESG Investing, Corporate & Board Advisory

Strategic Advisory / Sustainability & Responsible Investing

Strategic Advisory / Sustainability & Responsible Investing

We assist investors, investing teams, fund managers, financial institutions, regulators, stock exchanges, sovereign wealth funds, and governmental bodies to organize and review their selections based on multiple Sustainability and ESG frameworks.

We assist in benchmarking different ratings from agencies, data providers, and vendors.

In a complicated and continuously changing business environment, we provide guidance to assist companies repositioning their value proposition by taking into consideration the new “ESG Driving Forces”:

Investors & Financial Services

Access to and deployment of capital including cost of capital.

Employees

Attraction and retention of the right employee is associated to corporation’s positioning the ESG spectrum.

Securities Commissions

Setting a standard disclosures framework for publicly listed issuers with a focus towards integrated reporting.

Standard Setting Boards

Evolving from guidance for enhanced adoption of sustainability criteria to mandatory reporting.

Government

Policies will influence organizations’ actions with the view to reduce carbon emissions footprint (including conditions associated with the pandemic relief funding).

Regulators

Incorporating sustainability metrics to regulatory decision-making and funding process (grants & subsidies) for every new project

Clients

Stronger activism will impact clients’ tastes and habits as well as it will impact their decision-making process on how they select vendors and business partners

Supply Chain

Influencing participants within the full business cycle – upstream and downstream

Employees

Attraction and retention of the right employee is associated to corporation’s positioning the ESG spectrum

Securities Commissions

Setting a standard disclosures framework for publicly listed issuers with a focus towards integrated reporting

Standard Setting Boards

Evolving from guidance for enhanced adoption of sustainability criteria to mandatory reporting.

Investors & Financial Services

Access to and deployment of capital including cost of capital.

Regulators

Incorporating sustainability metrics to regulatory decision-making and funding process (grants & subsidies) for every new project

Supply Chain

Influencing participants within the full business cycle – upstream and downstream

Government

Policies will influence organizations’ actions with the view to reduce carbon emissions footprint (including conditions associated with the pandemic relief funding)

Clients

Stronger activism will impact clients’ tastes and habits as well as it will impact their decision-making process on how they select vendors and business partners

We Assist,

Investors to:

- Define and track the sustainability impacts, risks and performance of investment partners & direct investments.

- Monitor overall performance and report to stakeholders.

Governments, Regulators

& Stock Exchanges to:

Clearly define data and information to be disclosed (with related performance targets), define a framework and efficiently collect, review and monitor individual and group performance.

Corporates & SME’s to:

Define, assign & collect metrics, measure and improve ESG performance and communicate that performance to stakeholders (customers, investors, staff and more).

Contact us to assist you design your ESG strategy and Sustainability playbook

We train business owners and managers and assist them to navigate within the labyrinthine world of ESG frameworks, concepts, methodologies, indices & data measurements.

There is a series of issues in the ESG, while the concept of stewardship is increasingly important in the field of responsible investing

“Broadly speaking, stewardship reflects the role of investors as ‘stewards’ of the assets entrusted to them by their clients and the responsibility of investment professionals to carefully protect and enhance the value of those assets. It embodies the notion that investors are influential market players who have the power to shape markets, enhance governance and address market risks and opportunities affecting the health of the economy.”

Sources: Responsible Investment Association of Canada ![]()

![]()

Corporate & Board Advisory

Strategic Advice

With direct access to more than 3,000 equity providers globally (venture capital, private equity firms, family offices, corporations, and endowments) we are able to find the right strategic partner for your business, we can assist you in preparing your company to align its corporate strategy and structure so to navigate throughout the merger or acquisition path successfully and harmlessly.

Corporate Culture Design & Optimization

We can’t only help you prepare your business plan, but we can assist you in designing your intervention plan so to prepare or update your company’s Collective Vision, Mission, Values and Human Capital strategy, prior to any Merger and/or Acquisition.

We can assist you to: (i) Audit & Assess your Strategy, (ii) Develop and Implement a KPI framework, (iii) Remodel or Restructure your business, (iv) Monitor – Streamline & Optimize your company’s Functional processes, (v) Design & Implement your Performance Management system, (vi) Assess your organization’s Human Capital Dynamics, and (vii) Develop your Technology Strategy, Design the implementation of it, and Assess its results.

Succession Planning

We can assist family businesses to efficiently design and develop their strategy, update their business proposition as well as design carefully their succession plan on to the next generations.

According to a family business survey, which took place in 2016*1, “43% of family firms do not have a succession plan in place, with only 12% making it to a 3rd generation”; while another survey in 2020 *2 showed that “89% of family firms think that passing ownership on to the next generation is important to the sustainability of the business over generations and the creation of more jobs”.

1: A study of management practices, carried out by National Bureau of Economic Research Family Business Alliance. Retrieved October 2016:(http://www.fbagr.org/index.php?option=com_content&view=article&id=117&Itemid=75) / pwc-global-family-business-survey-2016-the-missing-middle.pdf

2: 2020 FEUSA, Family Business Survey, May 2020

Contact us to tell you how we can help you: advisors@chartered.associates

Strategic Advice Post Merger Integration

We assist management teams to set the direction, release value and create the new organization, after a merger, by following the below steps

Give a Direction

- Engage Senior Leadership (from both companies): Commitment, Credibility, Trust & Visibility

- Define an operating model and organize integration teams around the new values

- Set clear objectives and a distinct & discreet plan within a strict timeline

Release Value

- Design the integrated company, quickly and even before the completion of the deal

- Find synergies and economies of scales as quickly as possible, based on the merger’s objectives

- Use new technologies and digitalization as early as possible and as detailed as it can be

- Selectively forget the past, and keep the core of the current business ongoing, by engaging existing clients in the post-merger organization’s era

Create the New Organization

- Redesign and mutually decide the operating model, the earliest possible

- Attract, retain and develop talent

- Design the new organization’s culture

- Embed change management , Design and Optimize the new organization’s functional sub-systems

Contact us to tell you how we can help you: advisors@chartered.associates

Joint Ventures, Alliances, PPP, Privatizations

Strategic Alliances could boost your company’s innovative ability and skills.

Joint Ventures, irrelevant to the industry could reduce risks or costs but increasingly to spur innovation or achieve objectives that no partner could achieve on its own.

Public-Private Partnerships (PPP or P3) are used massively as the global populations migrate towards cities and the population of the globe itself is increasing exponentially. In addition, the need for new infrastructure associated to the sustainability, as it is dictated by the green and circular economy rules, has become more urgent and the PPP business models could be a solution. However, although there is tremendous potential to create value, there are cases where the Joint Ventures, PPPs, and Strategic Alliances, end up delivering fewer benefits than the involved parties expected.

Our teams and our prior experience can assist your companies and/or local governments to navigate and prepare for any of the above-mentioned tasks.

Contact us to tell you how we can help you: advisors@chartered.associates